When can i claim napsa benefits

პიტაია თმის შეჭრის კალენდარი 2023Claims FAQ - National Pension Scheme Authority. Claims FAQ Are ZNPF benefits adjusted to inflation? Can I claim my ZNPF benefits together with my NAPSA benefits? How long are pensions paid for? Does the rate of pension remain the same over the years? What happens to my contributions if I pass away? How is funeral grant calculated? How will I know how much I will be paid?. Benefits - National Pension Scheme Authority. If one decides to retire at the age of 60 and has made a minimum of 180 months of contributions, they will eligible for Normal Retirement Pension, while those that decides to retire at 60 years of age and have made a minimum of 180 months of contributions will eligible for Late Retirement Pension.. NAPSA LAUNCHES ONLINE BENEFIT CLAIMS - Home - National Pension Scheme .. The National Pension Scheme Authority has launched the e-Benefits, an online portal for submission of different types of benefit claims and for renewal of pension life certificates

serigne bass khelcom корм для собак

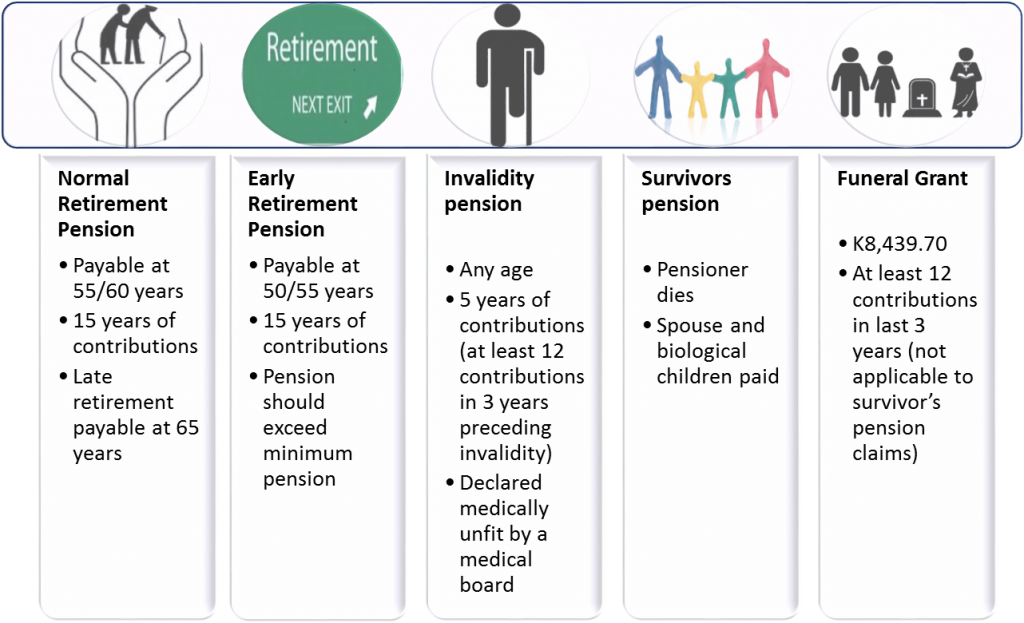

. Qualifications & Eligibility - National Pension Scheme Authority. members of NAPSA was revised as follows: Early retirement age - previously 50 years, now 55 years. Normal retirement age - previously 55 years, now 60 year. Late retirement age - 65 years. Members who joined the scheme after 14th August 2015 can claim their benefits at 55, 60 or 65 years. Members who joined the scheme before 14th August .. Claiming a Pensionkonuşanlar full izle comment annuler une promesse d achat de maison

. - Mywage.org/Zambia - WageIndicator Foundation. A worker who has retired from formal employment can claim their Pension from any National Pension Scheme Authority (NAPSA) office or any designated representative nationwide. Currently NAPSA is present in the countrys major cities such as such Lusaka, Mansa, Ndola, Livingstone, Kabwe, Kasama, Chipata, Mongu and Solwezi.. FAQs - NAPSA. A pension is paid for as long as a member is alive but guaranteed for 10 years. What benefits do the Trustees get from the Scheme? Since Trusteeship is not a full-time job, the Trustees are paid sitting allowances when they attend meetings. What is the normal retirement age? The normal retirement age for members of the Scheme is 55.. eNAPSA - National Pension Scheme Authority. Registerestola törőcsik dániel

. Submit . Pay . Statements using eNAPSA. For workers seeking to register with NAPSA for the first timerestaurant fruits de mer dakar 崩壞星穹鐵道兌換碼

. How do I apply for my benefits? - National Pension Scheme Authority. Once a member reaches retirement age, becomes invalid or passes away, the member or surviving beneficiaries should visit their nearest NAPSA office or mobile office with an original Identity Document for advice on how to claim their benefits.. Membership - NAPSA. Annual individual membership fee - $75.00capital cinemas continental gumi gyártási év

. Annual Organizational membership fee - $337.50 (includes 5 linked individual membership profiles or key contacts). E ach additional membership profile is $67.50. This is a 10% discount from the individual membership rate.. NAPSA Pre-retirement Lumpsum Benefits | How to Claim Partial - flatprofilenagasaon sdy senin orthopedic surgeons durban

. Jobs & Recruitment How to Claim NAPSA Pre-retirement Lumpsum Benefits Jobs & Recruitment Lifestyle How to Claim NAPSA Pre-retirement Lumpsum Benefits Admin Learn how to sign in National Pension Scheme Authority, NAPSA E-Services Portal to claim Pre-retirement lumpsum benefits and make a partial withdrawal of your NAPSA money.. Introduction - NAPSA. About NAPSA Staff Pension. NAPSA Staff Pension Scheme is a Single Employer Occupational Pension Scheme managing Pensions for National Pension Scheme Authority employees. The Scheme is registered under the Pension Scheme Regulation Act of 1996 and as amended in 2005. It is an approved Fund under the Income Tax Act Cap 323 of the Laws of Zambia .. ZNPF claims. - National Pension Scheme Authority - NAPSA - Facebook. December 28, 2022 ·. ZNPF claims and benefit payments update. 104. 74 comments. Most relevant. Musenge Musenge. The system at Napsa may be defective. Then some employers are not truthful in remittance of our contributions as deducted. Worked for zccm for 5yrs but only 1yr is reflecting.嘘喰いraw abu issa holding vacancy

. House passes bipartisan tax bill that expands child tax credit. The House voted on Wednesday evening to pass a $78 billion bipartisan tax package that would temporarily expand the child tax credit and restore a number of business tax benefitsgorenje rk6356w manual cfare eshte atomi

. The bill will .. 2024 tax refunds could be larger than last year due to new . - CBS News. How to maximize your 2024 tax refund, according to a CPA 02:34. Many Americans got a shock last year when the expiration of pandemic-era federal benefits resulted in their receiving a smaller tax .. eNAPSA FAQ - National Pension Scheme Authority. Step 1: Go to www.napsa.co.zm and click on e-Services-Login Step 2: Login a Data User and click on Returns tab. Step 3: Upload your return (saved in csv format) by clicking on Choose file and then on Submit file button to validate it. Step 4: Validation Summary will display the number of valid and invalid records.If no invalid records are found, click Next to confirm the uploaded return .. This Is the Average Social Security Benefit for a 70-Year-Old. The average Social Security benefit for a 70-year-old was $1,963.48 in December 2022, according to the most recent data from the Social Security Administration. That compares to just $1,274.87 for .. Online Services - National Pension Scheme Authority. NAPSA has implemented a number of platforms to allow our members and employers to access all our services online

como parar de gostar de alguém ディズニーチケット 友達に譲る

. In 2023, the tax brackets were adjusted upward by about 7% to account for last years high inflation. To see those .. US scientist recommends adding salt to make perfect cup of tea - BBC. The British claim to know a thing or two when it comes to making a good cup of tea. The beverage is a cultural institution in the UK, where an estimated 100 million cups are drunk every day.. Things to remember when filing 2023 tax returns. Make sure to enter $0 (zero dollars) for last years adjusted gross income (AGI) on the 2023 tax return. Everyone else should enter their prior years AGI from last years return. 4. Free resources are available to help eligible taxpayers file online. Free help may also be available to qualified taxpayers.. This Is the Average Social Security Benefit for a 70-Year-Old - MSN. Most Americans become eligible to claim Social Security when they turn 62. But if you want to make the most of your benefits, you might want to wait until you reach 70. The differences can be .. The Pre-retirement Lumpsum Benefit Is Here. 1. Qualifying criteria; 60 months contributions regardless of age but before retirement or 45 years and above regardless of contributions 2. Entitlement; 20% of total contributions. This will be indexed (interest added) 3